The old playbook for sourcing from China is dead. It’s a new world of tariffs, geopolitical tensions, and supply chain fragility. The lowest price is no longer a viable strategy. This article provides a new roadmap for US importers. It shows you how to build a resilient and profitable supply chain. We reveal how to leverage China’s unmatched scale and technical expertise. We do this while tackling the new challenges through practical strategies. Strategies like calculating true landed cost and managing the production process from afar.

Is China Still the Right Sourcing Partner for You?

Sourcing from China has never been more complicated. A decade ago, the focus was on price and quality. Now, it’s a minefield of tariffs, geopolitical tensions, and supply chain fragility. The rules of the game have changed, and for many, the old playbook no longer works. But despite these new risks, the potential for growth remains. This guide outlines what you need to build a resilient and profitable sourcing strategy in this dynamic game of sourcing from China.

China’s Core Value Proposition

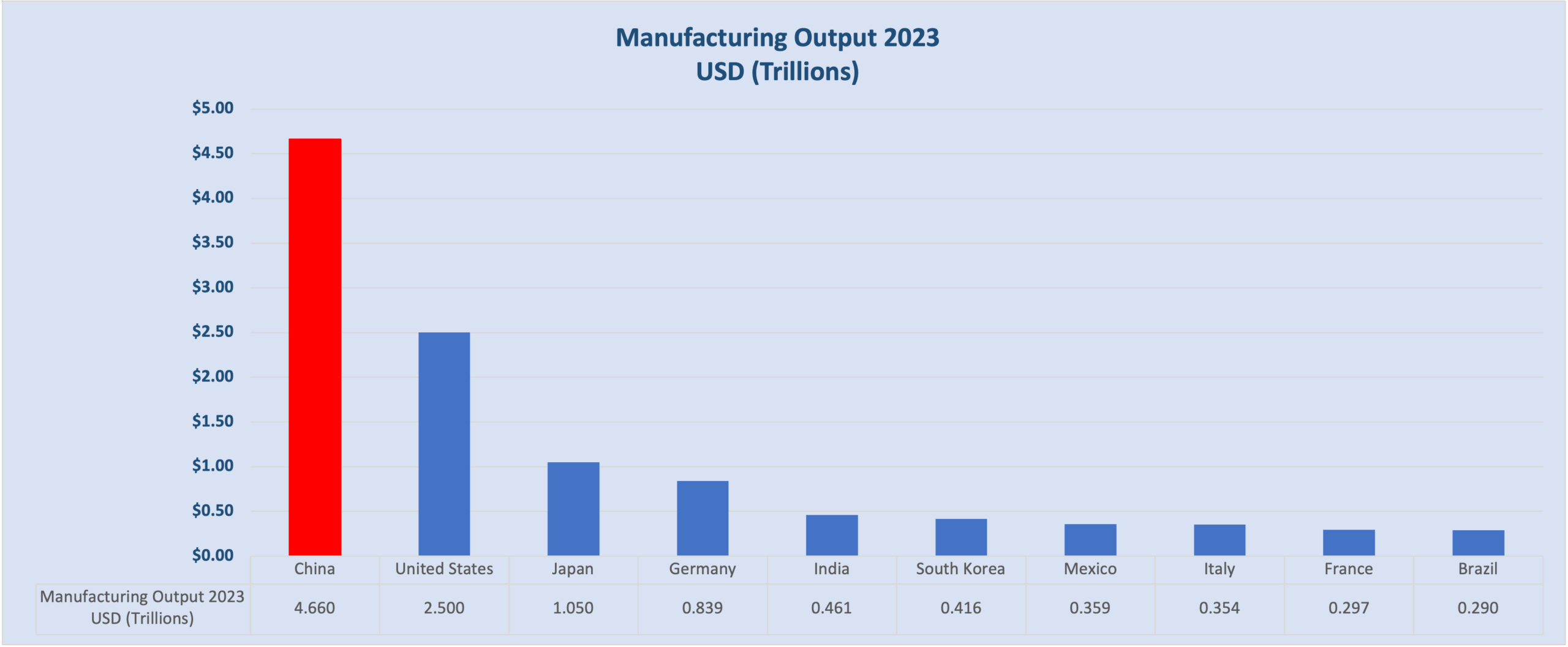

China is the biggest global exporter. In 2023, China’s exports were greater than those of the U.S.A., Japan, and Germany combined.

The three key factors that drove China to become the dominant global exporter are undiminished by efforts to undermine them. These three key factors work to the mutual advantage of Chinese exporters and U.S.-based importers. Together, they constitute China’s core value proposition, cementing its dominant position.

I) Economies of Scale and Supply Chain Density

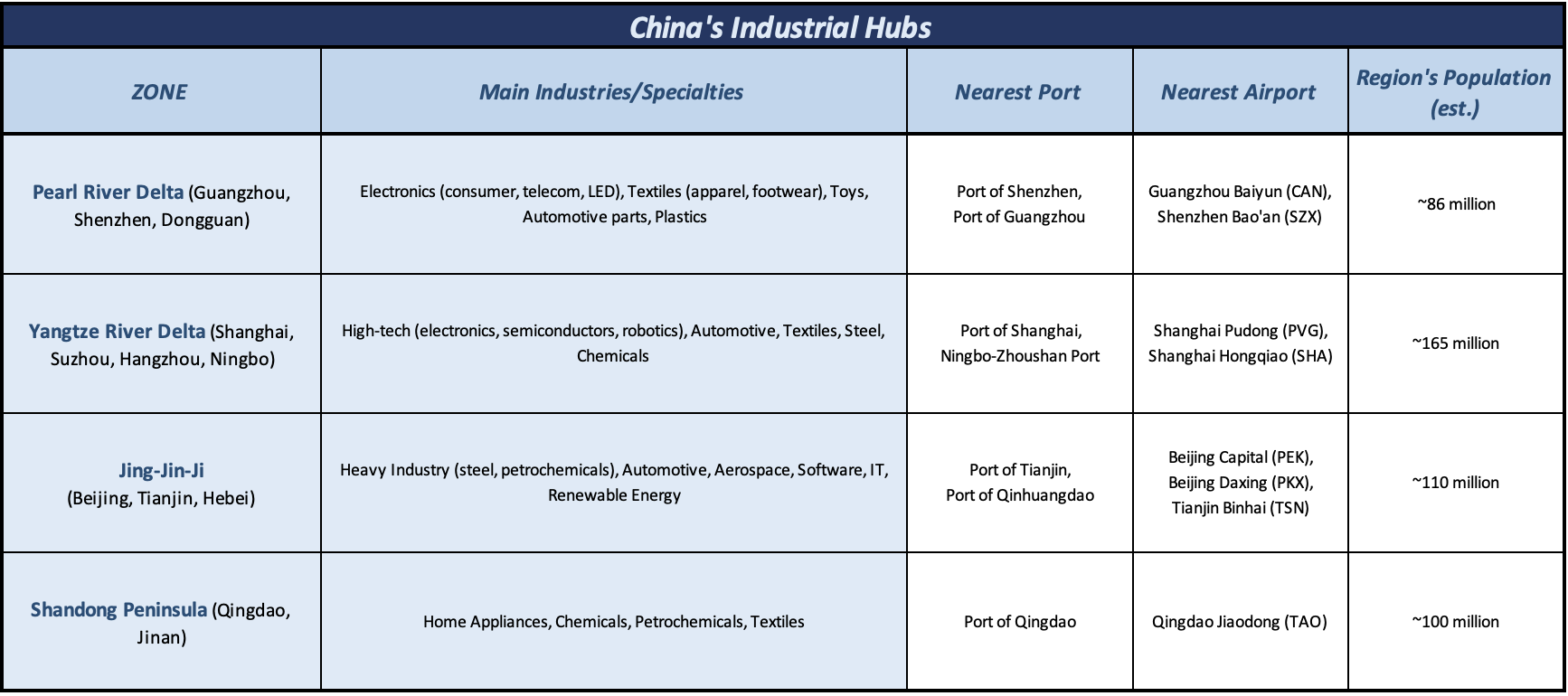

China’s industrial hubs are manufacturing networks unmatched in their size and depth. Each is a cluster of suppliers for raw materials, components, and specialized parts. Each offers shorter lead times, greater production flexibility, and cost savings through bulk purchasing and streamlined logistics. For you, this means they can develop your prototype, scale production, and source components from within a single region.

II) Advanced Manufacturing and Technical Expertise.

Low-cost labor was yesterday’s major advantage for China’s manufacturers. Today’s major advantage lies in its move into advanced, high-tech manufacturing. Investment in automation, robotics, and R&D created an industry capable of producing complex, high-quality, and innovative products. For you, this means access to state-of-the-art manufactured goods – from consumer electronics to advanced machinery.

III) Speed to Market and Production Agility.

China’s highly developed infrastructure and competitive manufacturing sector have a lead time from product design to mass production shorter than that of alternative sources. Chinese manufacturers have built in an ability to implement design changes to meet changing technology and consumer tastes. Good examples are the electronics manufacturer Xiaomi and the drone manufacturer DJI. This speed to market delivers a critical competitive advantage to entrepreneurs. They can test products, revise designs, and respond to consumer trends quickly.

The Shifting Landscape

China’s core value proposition remains a powerful draw, but these factors no longer define global trade. A decade of rising trade tension has altered the landscape for importers. The three new realities have redefined the sourcing relationship.

The Focus of Tariffs

Beyond the question of “What is today’s tariff rate?” is the question of “What sector is being targeted today for tariffs?” In late September 2025, a range of new tariffs was imposed on an odd assortment of imports. This included branded or patented pharmaceuticals (100%, with an exemption for importers constructing a manufacturing plant in the U.S.), kitchen cabinets and bathroom vanities (50%), upholstered furniture (30%), and heavy trucks (25%). These sectoral rates are themselves subject to previous tariff rate cap agreements, which limit their impact. European Union pharmaceutical manufacturers will enjoy a 15% cap. Chinese pharma will not.

Geopolitical Risk

Beyond tariffs, geopolitical risk has made the Chinese supply chain more fragile. The U.S./China relationship is now defined by strategic competition. This can lead to sudden, unpredictable policy changes. Examples include key technology export controls, retaliatory sanctions, or logistical disruptions. These events can stop production or shipments without warning. These are risks that you would not have faced a decade ago.

Evolving Cost Structures

China was synonymous with “low-cost manufacturing labor”. Yet, rising Chinese wages mean the country is no longer the cheapest option. New environmental regulations and rising raw material costs have added to costs. It is worth comparing the total landed cost from China against alternative sources. This homework will ensure you are getting the best value.

Managing Production

The difference between success and failure can come down to a few steps taken on the factory floor. Proactive and hands-on, importers can take control of their production and cut risk. This process hinges on three fundamental pillars:

Mastering MOQs and Cost

The concept of MOQ (Minimum Order Quantity) is a fundamental in manufacturing. Factories set these minimums to ensure profitability by covering their fixed costs. This includes machine setup and labor for a production run. For small businesses, high MOQs can be a significant barrier. The key is to understand that MOQs are often negotiable. You can agree on a smaller MOQ by offering a higher price per unit for a smaller run. You can order a variety of products (SKUs) to meet a combined MOQ. Or you can find manufacturers that can accommodate smaller orders.

Caveat Emptor! – Thorough Supplier Vetting

Supplier vetting is the critical step in avoiding excessive cost or low-quality product.

- Never rely on a listing from a B2B platform.

- Verify the potential supplier’s business license and registration through official Chinese government databases.

- Ask for and contact references from other US or Western clients.

- Consider hiring a third-party company to conduct an on-site factory audit. They can verify its production capabilities and ethical standards.

This due diligence is the best way to protect your investment.

Multi-Stage Quality Control

Quality control is a continuous process, not only a single inspection at the end. A sensible QC strategy should involve many stages to catch defects early. This includes:

- Pre-Production Inspection, a check of raw materials before manufacturing begins

- In Line Inspection, which involves random checks of products as they are being made

- Product Release where a finished product is on ‘Hold’ status until released by QC

- Pre-Shipment Inspection (PSI), which is a final check before loading for shipping. This final check is your last chance to ensure the product meets your quality standards.

Negotiating these processes remotely requires the help of an independent third-party inspection company.

Intellectual Property Rights Protection in China

It’s smart to be proactive about intellectual property (IP) when manufacturing in China. Headlines always focus on IP theft. Yet, China’s legal system offers protection for those who follow the proper steps. Protecting your designs/trademarks depends on you being proactive and understanding the law.

The First-to-File Rule

The system in the U.S. is a “first-to-use” system for trademarks and patents. The system in China is a “first-to-file” basis. This means whoever is the first to register an IP right in China has legal ownership. This is regardless of who created the product or used the brand first. Registering your trademark, patent, and copyright is critical before starting conversations with potential suppliers. Delaying this process risks having a “trademark squatter” claim your brand. This will force you to either pay to get it back or rebrand.

The Power of NNN Agreements

Generic Non-Disclosure Agreements (NDAs) used in the U.S. are often not enforceable in China. To protect your trade secrets and designs, you need to use a Chinese contract. Many legal experts now recommend an NNN Agreement—Non-Disclosure, Non-Use, and Non-Circumvention. This prohibits the manufacturer from disclosing confidential information. It prohibits them from producing their own competing products. It also stops them from skipping you to sell direct to your customers. Have these agreements written by legal professionals in both Chinese and English. Have them state that any disputes will be handled under Chinese law in a Chinese court.

A Multi-Layered Defense

Effective IP protection isn’t a single action; it’s a multi-layered defense strategy.

- You must also be proactive in monitoring your brand. Be selective in releasing information. If possible, only provide suppliers with the necessary details to produce specific components.

- You or your third-party inspection agent should conduct periodic factory audits. Ensure there are no unauthorized “night shifts” producing counterfeit versions of your goods.

- Finally, you must track online and offline markets for counterfeit products. Use legal or administrative channels to enforce your rights.

China’s legal system often rules in favor of foreign companies that register and defend their IP.

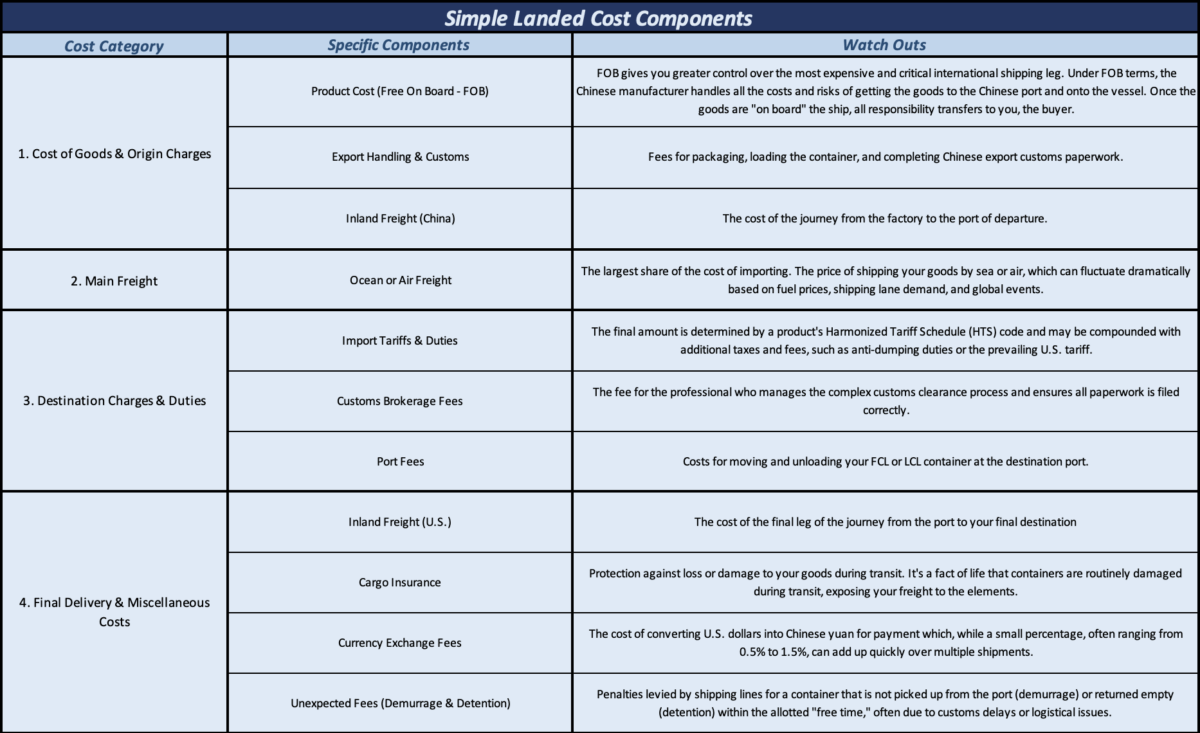

The True Landed Cost

A common mistake is to equate the factory price with the final cost of a product. The difference between business success and failure often lies in the accuracy of “landed costs.” This total figure is far more than the manufacturer’s quote. It depends on four critical cost categories outlined in the following table.

“What is the Chinese Government doing that could help me as an importer?”

The Chinese government is countering external efforts to undermine its manufacturing industry. It does not rely on the blunt tool and bad press of state subsidies. They are focusing on technological upgrades, strategic market diversification, and streamlining processes. Combined, these aim to strengthen China’s position and advancing into new areas.

Technological Upgrading and Industrial Policy

GOAL: Create innovative, high-value products that dominate internationally and are not reliant on foreign technology.

Significant investment is being made in high-tech sectors to boost their export competitiveness. Initiatives like the “Made in China 2025” plan launched in 2015 aim to accelerate the transformation from a producer of cheap, low-tech goods into a global leader in intelligent manufacturing. Under a common approach of green energy power, the application of AI, and self-reliance on new tech, targeted industries include:

- robotics,

- artificial intelligence

- electric vehicles

Financial Incentives and Tax Adjustments

GOAL: To strategically use tax and financial policies to increase export competitiveness in priority sectors while discouraging overproduction in others.

Like many governments, the Chinese government uses export tax rebates to lower the cost of exports. Instead of applying to all exporting industries, it is targeting rebates towards its strategic goals by;

- increasing support for high-tech and “green” products that are a priority for the national economy.

- reducing or eliminating rebates for industries with overcapacity, such as aluminum and steel.

Market Diversification and Cross-Border E-commerce

GOAL: To expand export markets and revenue streams by reducing reliance on traditional trade partners.

To reduce reliance on traditional markets like the U.S. and Europe, the government is actively promoting new trade channels and methods of reaching consumers. It is doing this through:

- Promoting trade with countries involved in the Belt and Road Initiative (BRI). This includes investments in infrastructure and new trade agreements to diversify its export destinations and reduce geopolitical risk.

- Supporting cross-border e-commerce platforms. The government has established numerous pilot zones (e.g., Hainan Island and Qinhuangdao) and implemented policies to facilitate online exports for small and medium-sized enterprises (SMEs), helping manufacturers reach global consumers directly and bypass traditional import channels.

Streamlining Bureaucracy

GOAL: To reduce the time taken and cost of international trade by improving the business environment for exporters.

The Chinese government is focused on export process efficiency. This is through a series of measures aimed at modernizing back-office systems and processes, including:

- Simplifying customs procedures (consolidation of the needs of various government agencies) to reduce delays at ports.

- Digitizing trade documentation to replace paper-based systems with more efficient electronic ones.

- Providing more efficient services for export credit insurance and financing.

Building your own resilient China Sourcing Strategy

The decision to import from China is no longer simple. If you can navigate its modern complexities and tariffs, the rewards remain significant. This guide has outlined the essential pillars for success. They stretch from mastering production and protecting your IP to understanding the true landed cost. Managing these complexities from a distance can be overwhelming for a small business. The opportunity to build a profitable and resilient supply chain remains stronger than ever. Successful importers take the right steps before committing your time, resources, and money. With the right expert partner, you can navigate these challenges with confidence. You can turn China’s manufacturing power into your greatest competitive advantage.